Lati aarin Oṣu kọkanla, ọja isopropanol Kannada ti ni iriri isọdọtun. Ohun ọgbin 100000 ton / isopropanol ni ile-iṣẹ akọkọ ti n ṣiṣẹ labẹ ẹru ti o dinku, eyiti o fa ọja naa ga. Ni afikun, nitori idinku iṣaaju, awọn agbedemeji ati akojo oja isalẹ wa ni ipele kekere. Ni iyanju nipasẹ awọn iroyin titun, awọn olura n ra lori awọn dips, ti o yọrisi aito igba diẹ ti ipese isopropanol. Lẹhinna, awọn iroyin okeere jade ati awọn aṣẹ pọ si, ni atilẹyin siwaju si igbegaisopropanol iye owo. Ni Oṣu kọkanla ọjọ 17, ọdun 2023, idiyele ọja ti isopropanol ni Agbegbe Jiangsu ti ṣeto si 8000-8200 yuan/ton, ilosoke ti 7.28% ni akawe si Oṣu kọkanla ọjọ 10.

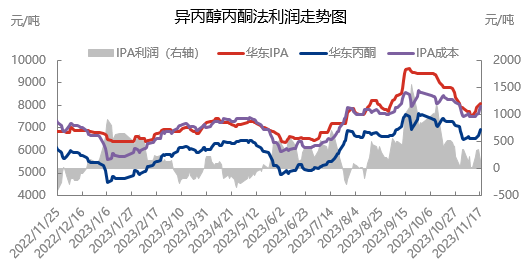

1,Atilẹyin idiyele ti o lagbara fun ilana isopropanol acetone

Lakoko yiyi, acetone ohun elo aise pọ si ni pataki, pẹlu idiyele itọkasi ti acetone ni Jiangsu bi Oṣu kọkanla ọjọ 17th ni 7950 yuan/ton, ilosoke ti 6.51% ni akawe si Oṣu kọkanla ọjọ 10th. Ni ibamu, iye owo isopropanol pọ si 7950 yuan / ton, oṣu kan ni ilosoke oṣu ti 5.65%. O nireti pe igbega ti ọja acetone yoo fa fifalẹ ni igba kukuru. Aisi wiwa awọn ọja ti o wọle ni ibudo ti yori si idinku ninu akojo ọja ibudo, ati pe awọn ọja inu ile ti ṣeto ni ibamu si ero. Awọn dimu ni awọn orisun iranran to lopin, ti o mu abajade atilẹyin idiyele ti o lagbara ati iwulo ti ko to ni gbigbe. Awọn ìfilọ jẹ duro ati ki o si oke. Awọn ile-iṣelọpọ ebute ti wọ ọja diẹdiẹ lati tun awọn ẹru kun, ti n pọ si iwọn idunadura.

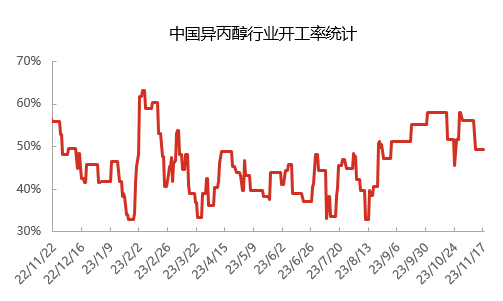

2,Oṣuwọn iṣiṣẹ ti ile-iṣẹ isopropanol ti dinku, ati ipese iranran ti dinku

Ni Oṣu kọkanla ọjọ 17th, apapọ oṣuwọn iṣiṣẹ ti ile-iṣẹ isopropanol ni Ilu China jẹ nipa 49%. Lara wọn, oṣuwọn iṣiṣẹ ti awọn ile-iṣẹ isopropanol orisun acetone jẹ nipa 50%, lakoko ti Lihua Yiwei Yuan's 100000 ton / ọdun isopropanol ọgbin ti dinku ẹru rẹ, ati iṣelọpọ isopropanol ti Huizhou Yuxin 50000 ton / ọdun ti tun dinku fifuye iṣelọpọ rẹ. Oṣuwọn iṣiṣẹ ti awọn ile-iṣẹ propylene isopropanol jẹ nipa 47%. Pẹlu idinku mimu ti akojo ọja ile-iṣelọpọ ati itara giga fun rira ni isalẹ, diẹ ninu awọn ile-iṣẹ ti mu awọn ero iṣipopada aṣẹ wọn ṣẹ tẹlẹ, ati awin ita wọn ni opin. Pelu idinku ninu itara atunṣe, awọn ile-iṣẹ tun wa ni idojukọ akọkọ lori jiṣẹ awọn aṣẹ ni igba kukuru, ati pe akojo oja wa ni kekere.

3,Oja lakaye ni ireti

Aworan

Gẹgẹbi awọn abajade iwadi ti iṣaro awọn olukopa ọja, 30% ti awọn iṣowo jẹ bearish si ọja iwaju. Wọn gbagbọ pe itẹwọgba isale lọwọlọwọ ti awọn idiyele giga n dinku, ati pe akoko atunṣe ipele ti pari, ati pe ẹgbẹ eletan yoo dinku. Ni akoko kanna, 38% ti awọn onile jẹ bullish lori ọja iwaju. Wọn gbagbọ pe o tun wa ṣi ṣeeṣe ti ilosoke agọ ninu acetone ohun elo aise, pẹlu atilẹyin idiyele to lagbara. Ni afikun, diẹ ninu awọn ile-iṣẹ ti o ti dinku ẹru wọn ko tii gbọ ti awọn ero lati mu ẹru wọn pọ si, ati pe ipese wa ni ihamọ. Pẹlu atilẹyin awọn ibere okeere, awọn iroyin rere ti o tẹle si wa.

Ni akojọpọ, botilẹjẹpe itara ifẹ si isalẹ ti dinku ati pe diẹ ninu awọn onile ko ni igbẹkẹle ti ko to ni ọjọ iwaju, o nireti pe akojo ọja ile-iṣẹ yoo wa ni kekere ni igba kukuru. Ile-iṣẹ naa yoo gba awọn aṣẹ alakoko ni akọkọ ati pe o ti gbọ pe awọn aṣẹ okeere wa labẹ idunadura. Eyi le ni ipa atilẹyin kan lori ọja, ati pe o nireti pe ọja isopropanol yoo wa lagbara ni igba diẹ. Sibẹsibẹ, ṣe akiyesi iṣeeṣe ti eletan alailagbara ati awọn titẹ idiyele, idagbasoke iwaju ti ile-iṣẹ isopropanol le ni opin.

Akoko ifiweranṣẹ: Oṣu kọkanla-21-2023