Ni Oṣu Kẹta Ọjọ 28, Ọdun 2018, Ile-iṣẹ ti Iṣowo ṣe ikede kan lori ipinnu ikẹhin ti iwadii ilodisi-idasonu ti bisphenol A ti a ko wọle ti o bẹrẹ ni Thailand. Lati Oṣu Kẹta Ọjọ 6, Ọdun 2018, oniṣẹ agbewọle yoo san owo-iṣẹ ilodisi ti o baamu si awọn aṣa ti Orilẹ-ede Eniyan ti Ilu China. PTT Phenol Co., Ltd. yoo gba 9.7%, ati awọn ile-iṣẹ Thai miiran yoo gba 31.0%. Akoko imuse jẹ ọdun marun lati Oṣu Kẹta Ọjọ 6, Ọdun 2018.

Iyẹn ni lati sọ, ni Oṣu Kẹta Ọjọ 5, ilodisi-idasonu ti bisphenol A ni Thailand ni ifowosi pari. Ipa wo ni ipese bisphenol A ni Thailand yoo ni lori ọja ile?

Thailand jẹ ọkan ninu awọn orisun agbewọle akọkọ ti bisphenol A ni Ilu China. Awọn ile-iṣẹ iṣelọpọ bisphenol A meji wa ni Thailand, laarin eyiti agbara Costron jẹ toonu 280000 fun ọdun kan, ati pe awọn ọja rẹ jẹ pataki fun lilo ti ara ẹni; Thailand PTT ni agbara lododun ti awọn toonu 150000, ati pe awọn ọja rẹ ni okeere si Ilu China. Lati ọdun 2018, okeere ti BPA lati Thailand jẹ ipilẹ okeere ti PTT.

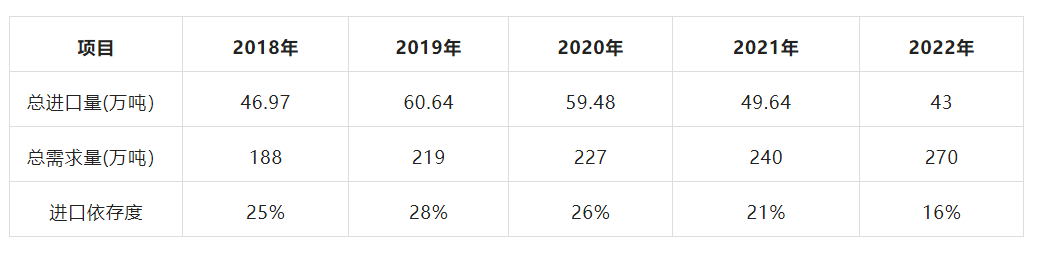

Lati ọdun 2018, agbewọle ti bisphenol A ni Thailand ti dinku ni ọdun nipasẹ ọdun. Ni ọdun 2018, iwọn gbigbe wọle jẹ awọn tonnu 133000, ati ni ọdun 2022, iwọn gbigbe wọle jẹ awọn toonu 66000 nikan, pẹlu iwọn idinku ti 50.4%. Awọn egboogi-idasonu ipa je kedere.

Nọmba 1 Yi pada ni opoiye bisphenol A ti a ṣe wọle lati Thailand nipasẹ China olusin 1

Idinku iwọn agbewọle le jẹ ibatan si awọn aaye meji. Ni akọkọ, lẹhin ti China ti paṣẹ awọn iṣẹ ipadanu lori BPA Thailand, ifigagbaga ti BPA Thailand ti kọ silẹ ati pe ipin ọja rẹ ti tẹdo nipasẹ awọn aṣelọpọ lati South Korea ati Taiwan, China Province of China; Ni ida keji, agbara iṣelọpọ ile bisphenol A ti pọ si lọdọọdun, ipese ti ara ẹni ti inu ile ti pọ si, ati igbẹkẹle ita ti dinku lọdọọdun.

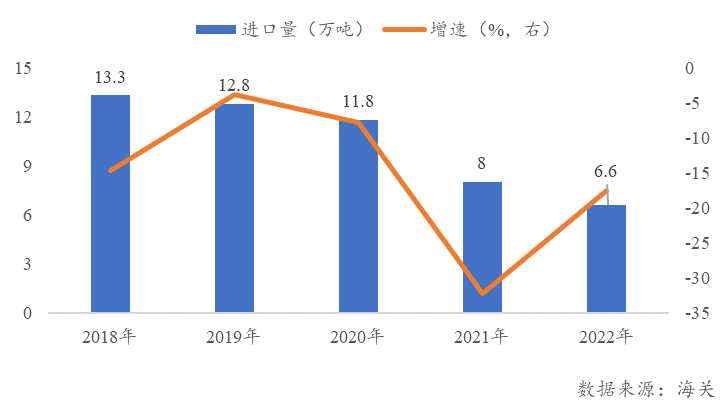

Tabili 1 Igbẹkẹle agbewọle Ilu China lori bisphenol A

Fun igba pipẹ, ọja Kannada tun jẹ ọja okeere pataki julọ ti BPA ni Thailand. Ti a ṣe afiwe pẹlu awọn orilẹ-ede miiran, ọja Kannada ni awọn anfani ti ijinna kukuru ati ẹru kekere. Lẹhin opin ilodi-idasonu, Thailand BPA ko ni owo-ori gbe wọle tabi iṣẹ idalenu. Ti a ṣe afiwe pẹlu awọn oludije Asia miiran, o ni awọn anfani idiyele ti o han gbangba. Ko ṣe ipinnu pe ọja okeere ti Thailand ti BPA si China yoo tun pada si diẹ sii ju 100000 toonu fun ọdun kan. Awọn abele bisphenol A gbóògì agbara ni o tobi, sugbon julọ ti awọn isalẹ PC tabi iposii resini eweko ti wa ni ipese, ati awọn gangan okeere iwọn didun jẹ jina kere ju awọn gbóògì agbara. Paapaa botilẹjẹpe iwọn agbewọle ti bisphenol A ni Thailand lọ silẹ si awọn toonu 6.6 ni ọdun 2022, o tun ṣe iṣiro fun ipin lapapọ awọn ẹru ile.

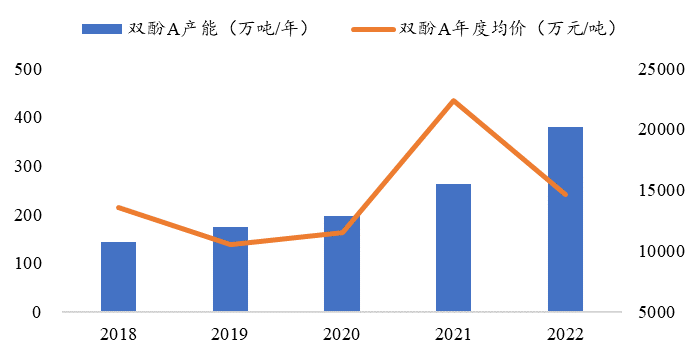

Pẹlu aṣa idagbasoke ti iṣọpọ ile-iṣẹ, iwọn ibaramu ti oke inu ile ati isalẹ ti n pọ si ni diėdiė, ati pe bisphenol A ọja China yoo wa ni akoko imugboroja iyara ti agbara iṣelọpọ. Ni ọdun 2022, awọn ile-iṣẹ iṣelọpọ bisphenol A 16 wa ni Ilu China pẹlu agbara ọdọọdun ti o ju 3.8 milionu toonu, eyiti 1.17 milionu toonu yoo fi kun ni ọdun 2022. Gẹgẹbi awọn iṣiro, yoo tun jẹ diẹ sii ju miliọnu kan toonu ti agbara iṣelọpọ tuntun ti bisphenol A ni Ilu China, ati ni ipo 202 ti ọja bisphenol diẹ sii ni 2023 bisphens. pọ si.

Ṣe nọmba 22018-2022 Agbara iṣelọpọ ati awọn iyipada idiyele ti bisphenol A ni Ilu China

Lati idaji keji ti ọdun 2022, pẹlu ilọsiwaju ilọsiwaju ti ipese, idiyele inu ile ti bisphenol A ti lọ silẹ ni kiakia, ati pe idiyele bisphenol A ti yika laini idiyele ni awọn oṣu aipẹ. Ni ẹẹkeji, lati iwoye ti idiyele ohun elo aise ti bisphenol A, phenol ohun elo aise ti o wọle lati Ilu China tun wa ni akoko ilodisi. Ti a ṣe afiwe pẹlu ọja kariaye, idiyele ohun elo aise ti bisphenol Abele ti ga julọ, ati pe ko si anfani ifigagbaga idiyele. Ilọsoke ti ipese BPA ti owo kekere lati Thailand ti nwọle China yoo daju pe o dinku idiyele ile ti BPA.

Pẹlu ipari ti bisphenol A anti-dumping ti Thailand, ọja ile bisphenol A yoo ni lati ru titẹ ti imugboroja iyara ti agbara iṣelọpọ ile ni apa kan, ati tun fa ipa ti awọn orisun agbewọle kekere ti Thailand. O ti wa ni o ti ṣe yẹ wipe awọn abele bisphenol A owo yoo tesiwaju lati wa labẹ titẹ ni 2023, ati awọn homogenization ati kekere owo idije ni abele bisphenol A oja yoo di diẹ intense.

Akoko ifiweranṣẹ: Oṣu Kẹta-14-2023